Understanding the Mortgage Process for Lenders

For those in the lending industry, grasping the intricacies of the mortgage process for lenders is crucial not only for personal success but also for guiding potential borrowers successfully. The mortgage process is the term used to describe the series of steps both borrowers and lenders must navigate in order to secure financing for a home. This comprehensive guide will explain each critical stage, emphasizing the importance and nuances of the lending perspective, thereby ensuring an efficient and successful mortgage experience.

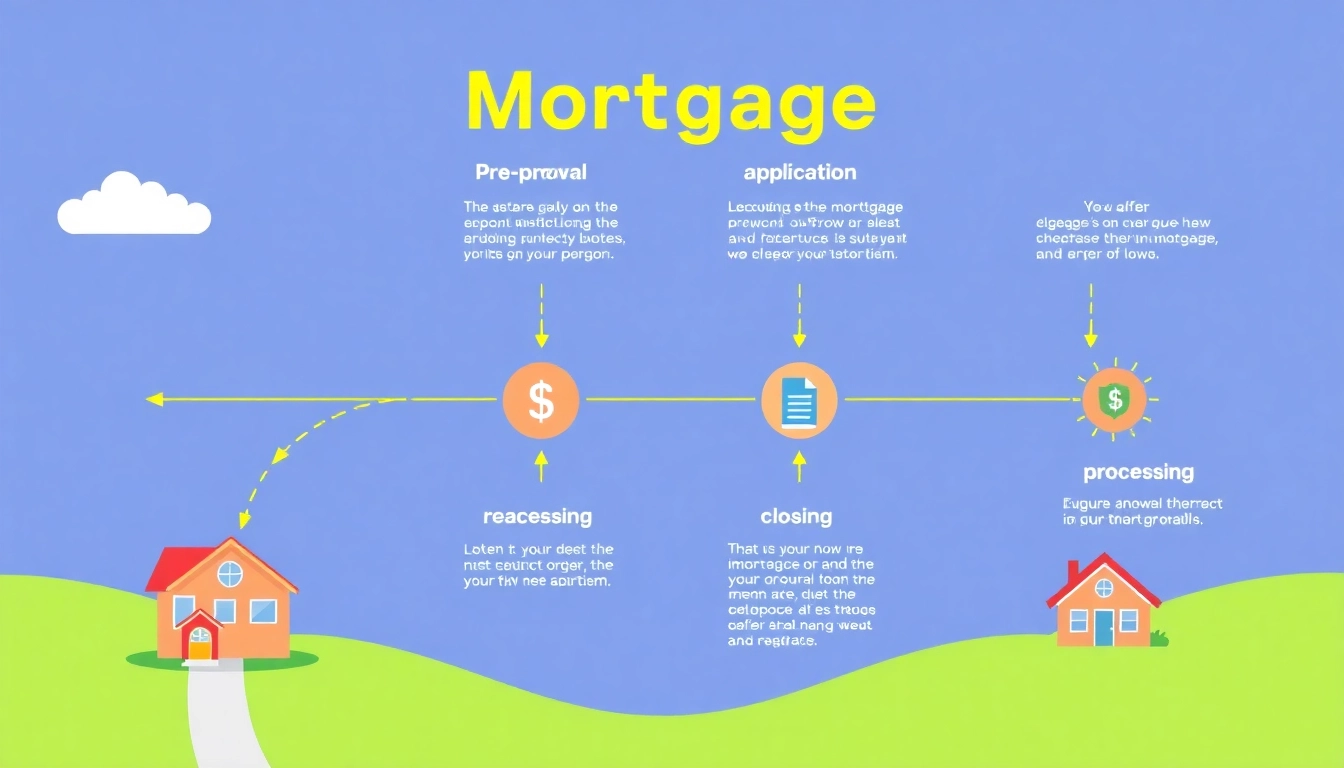

What is the Mortgage Process?

The mortgage process encompasses a series of defined stages that both lenders and borrowers must navigate to secure a mortgage. Traditionally, it consists of six key phases:

- Pre-approval

- House shopping

- Mortgage application

- Loan processing

- Underwriting

- Closing

Each phase is essential for both parties as it establishes the groundwork for a successful closing. For lenders, understanding these phases allows for a streamlined experience, reducing risk and increasing customer satisfaction.

Importance of the Mortgage Process

The mortgage process is vital for establishing trust between lenders and borrowers. A detailed understanding of each phase equips lenders to evaluate risks, provide accurate information, and meet regulatory requirements. Efficiency in this process not only helps in building a solid reputation but can also drive profits through lower operating costs and higher customer retention. Essentially, a comprehensively managed mortgage process can lead to quicker closings, enhancing both lender and borrower experiences.

Key Stages Overview

Each step of the mortgage process has specific requirements and implications. A thorough knowledge of these can assist lenders in preemptively addressing challenges and improving the overall efficiency of the operation.

- Pre-approval: This step involves preliminary checks on the borrower’s creditworthiness.

- Mortgage Application: The collection of detailed financial information and documentation needed for loan evaluation.

- Processing: Validation of the application and preparation for underwriting.

- Underwriting: A crucial step for assessing risk and deciding loan eligibility.

- Closing: This finalizes the transaction, enabling funds to be transferred and ownership to change hands.

Initial Steps in the Mortgage Process: Pre-Approval

Gathering Necessary Documentation

The pre-approval stage is foundational, as it sets the tone for the rest of the mortgage process. Lenders need to collect essential documentation that proves the borrower’s financial stability. Key documents typically include:

- Tax returns and W-2s

- Recent pay stubs

- Bank statements

- Proof of additional income sources (if applicable)

- Details about existing debts and obligations

Organizing these documents helps streamline the entire process and allows lenders to quickly assess the borrower’s financial situation.

Ensuring Good Credit Standing

The importance of credit scores in the mortgage process cannot be overstated. Lenders use these scores to evaluate the risk associated with lending to a borrower. In general, a score of 740 or above will afford the borrower access to the best rates. Lenders should advise potential borrowers on how to improve their credit scores by:

- Paying bills on time

- Avoiding unnecessary credit inquiries

- Reducing credit card balances

Taking these steps can significantly impact their pre-approval outcomes.

Understanding Pre-Approval vs. Pre-Qualification

Many borrowers confuse pre-approval with pre-qualification. While pre-qualification is a more informal estimate of borrowing capability, pre-approval is a formal process that assesses a borrower’s creditworthiness. Lenders must clarify this difference to ensure borrowers understand their standing in the process, which ultimately helps manage expectations and fosters trust.

Navigating the Application Phase

Submitting a Mortgage Application

Once pre-approval has been achieved, the next step is the mortgage application submission. During this phase, the borrower completes a mortgage application that collects detailed financial and personal history. Lenders typically require borrowers to provide more extensive information compared to pre-approval, and may ask for:

- Full employment history

- The specifics of the desired mortgage terms

- Detailed property information

Each piece of information impacts the risk assessment and ultimately the loan terms offered.

Choosing the Right Loan Option

Borrowers have various options for mortgage types, including fixed-rate loans, adjustable-rate loans, and government-backed loans. Lenders play a crucial role in guiding borrowers through these options, helping them choose based on factors like:

- Borrower’s risk tolerance

- Current interest rates

- Market trends

By offering personalized advice, lenders can create a tailored mortgage solution that aligns with the borrower’s needs.

Communicating with Loan Officers

Effective communication with loan officers is critical throughout the application phase. Regular updates and responses to any borrower inquiries can help maintain engagement and ensure a smooth processing period. Loan officers should be accessible and ready to offer advice and address concerns that may arise.

Processing and Underwriting Stages

What Happens During Processing?

Once the mortgage application is submitted, the processing phase begins. This phase involves confirming the accuracy of documents, gathering further required information, and preparing the file for underwriting. Some key tasks performed by lenders during this phase include:

- Collecting any missing documentation

- Ordering necessary services such as appraisals and inspections

- Verifying borrower’s employment and income

Timeliness in processing is vital; delays can result in dissatisfaction for borrowers and lost opportunities for lenders.

Understanding the Underwriting Criteria

Underwriting is where the lender evaluates the risk of the mortgage application. Underwriters will weigh the borrower’s financial stability, including credit scores, income, employment history, and other debt obligations. Typically, they utilize a few key criteria known as the “three C’s” of underwriting:

- Character: The borrower’s creditworthiness and history of timely payments.

- Capacity: The ability of the borrower to repay the loan, assessed through income verification and debt-to-income ratios.

- Capital: The financial assets and net worth of the borrower that signify financial health.

Understanding these criteria allows lenders to streamline decision-making while balancing risk and opportunity.

Dealing with Common Processing Delays

Delays can be one of the most frustrating aspects of the mortgage process for both lenders and borrowers. Common causes of delay include:

- Incomplete documentation

- Issues during the appraisal or inspection

- Underwriter requirements for additional information

By proactively addressing potential delay causes upfront and establishing clear communication practices, lenders can significantly improve timelines and borrower experience.

Finalizing the Mortgage: Closing Procedures

Preparing for Closing Costs

The closing procedure is the final step in the mortgage process where all aspects are confirmed to allow the transaction to finalize. Lenders need to prepare borrowers for closing costs, which can include:

- Loan origination fees

- Appraisal fees

- Homeowners insurance

- Title searches and insurance

- Recording fees

Clear communication regarding these costs will prevent surprises for borrowers, paving the way for a successful closing experience.

Importance of Title and Home Inspection

Prior to closing, it’s essential that a title search and home inspection be completed to ensure there are no legal issues with the property and that it is in good condition. Lenders should emphasize the value of these steps to borrowers as they prevent future complications. A clean title and satisfactory inspection can be significant selling points for lenders.

Post-Closing Responsibilities for Lenders

After closing, lenders have certain responsibilities that must be upheld. These include:

- Providing accurate documentation of the loan details to the borrower.

- Setting up an escrow account for property taxes and insurance.

- Maintaining open lines of communication regarding mortgage payment schedules.

Effective post-closing management enhances customer satisfaction and sets the stage for prospective referrals and repeat business.